Legal documents outline the much-speculated-on ouster of co-founder and former TuneCore CEO Jeff Price.

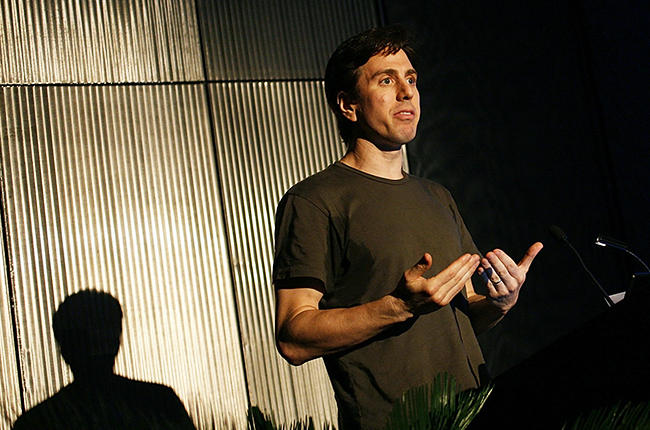

A lawsuit over severance pay filed by TuneCore co-founder and former CEO Jeff Price against the online music distribution service sheds some light on how the innovative but controversial executive was ousted from the company in 2012.

According to Price’s affidavit, which was included among documents filed June 4, 2014 at the New York State Supreme Court, he was booted from the company after TuneCore experienced a cash-flow crisis in 2012. The company’s fiscal difficulty prompted its primary outside equity investor, Opus Capital’s Gill Cogan, to wrest control of the day-to-day operations of the company from Price in May and to fire him on July 20.

The Price complaint, filed at the same court on Sept. 13, 2013, alleges that he was terminated without cause by Cogan, who, he claims in his affidavit, told him he was being fired because the cash-flow crisis had led to a lack of confidence in company management.

Tunecore Artists See Big Streaming Gains, Bring In Over $130 Million in 2014

Yet Price, who declined to comment for this article, contended in his affidavit that Cogan’s inaction was the main reason that the cash-flow crisis occurred. He alleged that after budget plans had been approved and large cash outlays made, Cogan withheld funds from an Opus Capital credit line that Price thought could be drawn down to fund TuneCore operations.

Cogan and TuneCore declined to comment on the lawsuit, and a company motion to dismiss the lawsuit does not address the events that Price claims led to his termination. Instead, the TuneCore response in court documents mainly focuses on refuting Price’s severance claims.

In a response to the motion to dismiss, Price’s lawyer John Carlson said that his client’s suit can’t properly convey the “tale of betrayal and ego that lies behind the refusal to pay Mr. Price the money he is owed.”

Founded in 2005 by Price, Peter Wells, and Gary Burke, TuneCore revolutionized the distribution business, giving independent, do-it-yourself artists the opportunity to hock their wares alongside established acts and superstars on iTunes and other digital services. For an annual fee, initially of $1 a song and $8 an album — which later reached $50 a year per album title — it provided distribution to digital services and promised to pay all revenue collected from those services back to artists. As hundreds of thousands of artists took advantage of the distribution channel, the company needed capital to fund further growth.

In the Spring of 2006, Marty Albertson, the chairman and chief executive of Guitar Center, invested $2 million in equity of his company’s money into TuneCore. In 2008, Opus Capital, led by Gil Cogan, invested $7 million in equity into the company. Both executives joined the company’s board of directors.

TuneCore Partners With Drag & Drop Mastering Program MixGenius

In late 2010, the complaint says Cogan asked Price to attempt to raise another round of funding for a global music publishing administration effort. Opus later agreed to lend TuneCore $4 million.

TuneCore’s operating budget subsequently was “prepared with the assumption that the $4 million was available to the company to be drawn down on at any time,” according to the complaint. When the funding was made available, TuneCore immediately drew down $2 million “for general corporate uses.” In January 2012, TuneCore withdrew another $1 million, leaving $1 million in untapped funding.

The Price affidavit states that from Jan. 1 through Feb. 28, 2012, Price and CEO Scott Ackerman continued to work on the 2012 budget for TuneCore with input from the board. Those proceedings included numerous e-mails and phone calls between the three board members and the two company executives, the document states. Moreover, all of the e-mails referred to the infusion of the last $1 million from Opus, needed to fund the employee bonuses. “Since I never received a bonus… I had absolutely nothing to gain… through the payment of bonuses,” Price said in his affidavit.

On Feb 28, the board approved the budget, which included $700,000 in bonus payments. But Price alleges in his affidavit that when he attempted to draw down the last $1 million from Opus Capital (the company was running short on cash — a situation that the board was aware of, he claims), Cogan would not allow it.

The lawsuit alleges that, in a conversation with Price, Cogan said he’d made the decision to shut off access to the remaining $1 million in the fund in February. That was prior to the board’s approval of the budget but Cogan did not disclose his decision to the board, according to the Price complaint. The Price affidavit also claimed that Cogan blamed Price for the cash shortage and told him he should have brought it to the board’s attention.

After Cogan allegedly told Price that he had lost confidence in TuneCore management, Price in his affidavit says he argued back to Cogan that the company’s cash-flow situation was conveyed during budget discussions and that making the remaining $1 million from the fund available would have solved the problem.

TuneCore Buys ‘Location Goodie Bag’ Startup DropKloud

“Gill disagreed and insisted that my actions had caused the company to become insolvent,” Price claims in his affidavit. During a conference call, Cogan insisted that the board call the company’s law firm, O’Melveny & Myers, for an opinion.

When companies are declared insolvent, they usually move to raise capital fast, and/or attempt to negotiate an out-of court restructuring in order to avert a Chapter 11 filing. In either of the latter scenarios, the equity of shareholders, like Price, Guitar Center and Opus Capital could be at risk because those processes then favor protecting the debt holders, like Opus Capital.

According to the affidavit, the firm did not agree that TuneCore was insolvent. “Mr. Cogan’s insistence that I had harmed the company was bewildering to me, and is at the heart of the unfortunate animus that continues to exist between us,” Price says in his affidavit. “To this day I am not sure what Mr. Cogan was trying to accomplish by this call [to the law firm] but the damage to our relationship was substantial.”

He continues: “If I made a mistake, which I emphatically deny, it was one that was out in the open and one that my board could have helped me to prevent. There [were] no secrets…. nothing was hidden from the other three board members.”

TuneCore’s cash-flow crisis was subsequently averted, although how that was accomplished is not explained in the court documents. But after that incident, Cogan expressed his desire to be named “executive” chairman of TuneCore. His wish was granted in May. Price’s termination came in July.

Shortly after Price left, another co-founder and shareholder, Gary Burke, TuneCore’s lead developer and engineer of user interface, was also terminated. To this day, sources tell Billboard all of the original TuneCore shareholders still hold their equity in the company but are in the dark about the company’s performance because TuneCore refuses to hold a shareholder’s meeting.

Price has since founded Audiam, which helps songwriters and publishing firms search out and unlock black-box royalties from digital services and collection societies around the world.

TuneCore’s motion to dismiss Price’s suit, filed on May 15, 2014, deals strictly with the issue of whether Price is entitled to severance pay, although TuneCore lawyers did make reference to his description of events in a June 17 memorandum filing on the the motion to dismiss.

“Price’s opposition, and the lengthy affidavit that accompanies it, paint a picture of a man so enamored with himself that he simply cannot accept that the rules that apply to everyone else should also apply to him,” Tunecore attorneys Eric Amdursky and Sloane Ackerman of O’Melveny & Myers said in the filing.